With used car values falling much of the past year, the percentage of collision-damaged vehicles being declared total losses is on the rise---and so too is the percentage of shops being reimbursed for the steps involved in processing total losses.

That’s among the findings of a “Who Pays for What?” survey over the summer.

“Because the process has continued to become more complex and time-consuming, shops are increasingly billing for the time they spend processing total losses, and rightly so,” said shop consultant Mike Anderson of Collision Advice, who conducts the quarterly “Who Pays” surveys. “Of course, some insurers are pushing back. In some cases, insurers have turned to using bill collection agencies in an attempt to go after shops after the fact to recoup amounts paid. While the industry continues to discuss the best way to bill for this, from a legal perspective shops should have an attorney review their authorization forms to ensure they are protected.”

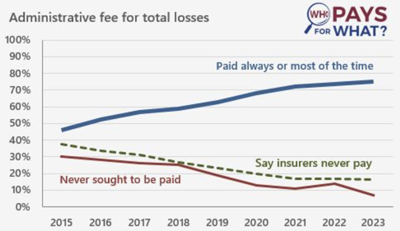

The survey, completed by more than 500 shops around the country, found only 7% of shops said they never seek to be paid for total loss processing. That’s down from 14% in the same survey a year earlier, and far below the 30% of shops that never billed total loss processing fees in 2015.

The “Who Pays” surveys ask shops how regularly they are paid by the eight largest national insurers for various procedures they perform. The percentage regularly being paid for total loss processing has been increasing. Eight years ago, just 46% of shops said they were paid “always” or “most of the time” when billing for total losses, but today 75% of shops say they are.

“Rather than simply billing an ‘administrative fee’ for this work, we are seeing shops itemizing the steps involved, such as a repair plan fee, disassembly fee or OEM research time,” Anderson said. “With 93% of shops regularly billing for this added work, it will be interesting to watch how AI impacts total loss processing, identifying total loss vehicles earlier in the process, possibly avoiding many of these fees at the shop, as well as storage charges.”

Removing Coatings from Pinch Welds

Just under 61% of shops taking the “Who Pays” survey this past summer said they are paid “always” or “most of the time” for removing coatings from pinch welds prior to mounting the vehicle on a frame machine---virtually the same percentage that have said that was the case for the past eight years.

“We have seen a lot of positive change over the years in many of the not-included labor procedures asked about in the ‘Who Pays’ surveys, so results like this one baffle me,” Anderson said. “I would encourage anyone who is not being paid for this to research it through the OEMs, I-CAR or any frame equipment companies. Ask if it is okay to mount a fixture clamp over a pinch weld covered with undercoating or seam sealer. You will find that the answer is a clear: No, it isn’t.”

Failure to remove the coatings increases the likelihood the vehicle can slip when the technician is pulling it, Anderson said, and that can cause further damage or adversely impacting the accuracy of the measurements.

“Shops need to understand that their technicians must be doing this,” he said.

Segmenting the data by insurance company does show some striking differences, however. Nearly 91% of State Farm direct repair shops say they are regularly paid for this operation, for example. That compares to just 61% of Progressive DRP shops that say that. Less than 2% of State Farm DRPs say the insurer “never” pays for this procedure, but more than 12% of Progressive DRP shops say Progressive “never” pays for it.

Anderson said he is concerned about the number of photos he sees on shops’ social media showing vehicles being anchored in ways not approved by the vehicle’s manufacturer.

“I have not found any vehicle manufacturer or any frame equipment company that says it’s OK to secure a fixture clamp to pinch welds without first removing all undercoating and seam sealer,” he said. “But also keep in mind, not all vehicles may be anchored on the pinch welds. It is critical that shops do the research to determine what is and is not permitted by the OEM for a safe and proper repair on each vehicle.”

Added Steps When Reconnecting Battery

Unlike the pinch weld procedure, other items asked about in the surveys have seen big changes in just a year or two. When asked how often repairers are researching the OEM procedures required after reconnecting a battery in 2023, 34% said they do it “all the time”---up from just 20% in 2022---and another 22% said they do it most of the time.

These procedures, depending on the automaker, can include initializing sensors or clearing trouble codes.

“I was analyzing the procedures called for by one Asian OEM recently and found 11 procedures required after reconnecting the battery,” Anderson said. “Researching procedures needs to happen every single time on every single vehicle. Disconnecting the battery often will set diagnostic trouble codes (DTCs) that you can’t check for without doing a post-repair scan in conjunction with reconnecting the battery.”

On the reimbursement side of the equation, more than half of shops (57%) that bill for the battery reconnect procedures say they are regularly paid to perform them---even while about 1 in 4 shops have never sought to be paid for these OEM-specified procedures.

More on OEM Procedure Research

In terms of OEM procedure research more generally, three out of five shops now say they research the procedures “always” or “most of the time” when they write an estimate or repair plan, according to the survey findings. That percentage has inched up slowly year after year since 2017, when 53% said they were conducting such research regularly.

About half the shops said an estimator or repair planner was primarily responsible for conducting that research, while about 1 in 3 shops (34%) said the work was done jointly by technicians and estimators.

The survey asked whether shops include a separate line item charge for the subscription fees associated with accessing OEM repair procedures. (Administrative fees are prohibited under California Bureau of Automotive Repair regulations.) About 3 in 10 shops (29%) nationally say they always or almost always include such a fee. About one-third charge a fee when needing to access an information source for which the shop doesn’t have an annual subscription.

More than 1 in 3 shops (37%) say they never pass along a charge for repair information subscription fees, but that’s down significantly from 42% in 2021 and 57% back in 2019.

Anderson said he will resume hosting webinars in 2024 that show how to navigate the automakers’ repair information websites, but several such webinars, related to the VW, Nissan and Subaru information portals, are available on the Collision Advice YouTube channel.

Shops can visit www.crashnetwork.com/whopays to take the January “Who Pays” survey, which focuses on not-included refinish labor procedures, or to download results of prior surveys.