As vehicle manufacturers announce plans to go all-electric by 2030, repairers and insurers are keeping a close eye on the changes taking place and adapting as necessary.

Mitchell International, Inc., an Enlyte company, recently released its inaugural quarterly trends report: “Plugged-In: EV Collision Insights,” which provides insight into the electric vehicle (EV) claims and market data and analyzes industry trends. EV sales in 2022 represented 5.6% of the market, according to Kelley Blue Book.

Ryan Mandell, director of claims performance at Mitchell, said the report will help carriers and collision repairers prepare as EV market growth continues and more EVs enter auto body shops.

“For the repair industry, additional training, tooling and equipment will be necessary considerations to meet the needs of these complex and interconnected vehicles,” the report said. “Automotive insurers, on the other hand, should be ready to examine underwriting practices so that they can meet the demands of a growing segment of the car parc with higher average repair costs and more complex repair procedures that must be performed to successfully deliver a proper and safe repair.”

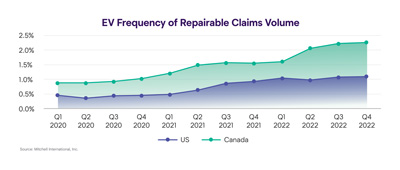

As of Q4 2022, EV repairable claims frequency was 1.1% in the U.S. and 2.26% in Canada, according to the report. The top North American EV markets based on repairable claims frequency were British Columbia (4.47%), California (3.37%) and Quebec (2.75%).

Autobody News reached out to Mandell to learn about the quarterly trends report, the data it includes and what it means for the industry moving forward.

What prompted the development of the quarterly EV report?

Mitchell’s previous trends report transitioned into an annual report when Enlyte, our parent brand, was formed in October 2021. We looked at opportunities to share insightful data that would be helpful for the greatest number of stakeholders---information different than they could find anywhere else.

The transition to EVs is a big disruptor, probably more so than anything we've seen in some time. We are seeing EV adoption numbers increasing and more coming into repair facilities.

It made sense to put out focused information about electrification and what it means for the industry. Insurers are asking how this transition will likely impact severity. That was something we knew we had to include.

We also wanted to demystify EVs and provide insights into what it means when these vehicles come into repair facilities. If you live in Southern California, you probably see EVs all the time, but if you are in another area of the country, you might not. A large section of the industry isn’t sure when they need to prepare for electrification, if they even need to, and if there is anything different with EVs. Whether or not people agree with the EV trend, people are buying them and it’s important to get prepared.

Our goal is to get information to carriers and shops, explain the market differences with EVs, and what to expect. The data shared is based on repairable estimates uploaded to Mitchell and we’ll continue to evolve the report.

Who is your main target audience?

It’s both insurers and repairers. Repairers are more on the front lines understanding some of the differences with these vehicles because they're living it firsthand. However, that's only in certain markets.

I work with many insurance carriers and the goal is to get them thinking about the EV business and how they will need to adapt their claims organization. An EV is a very different vehicle. They will need to think about the safety of appraisers in the field. They must understand how shops manage high-voltage batteries to ensure the safety of their teams.

What highlights can you share?

It was interesting to see how big of an impact Tesla has on the overall EV industry, with a 76.21% market share in the U.S. and 70.21% in Canada. When you look at that delta in terms of repair cost, it can be startling at first. But when you take Tesla out of that mix, it normalizes it a little more.

Teslas are complex and more expensive to repair. However, it’s not just the Tesla effect. Even without Tesla, you still have a significant delta in the repair cost for EVs because there’s more involved.

The number of mechanical labor hours on EV estimates still outpaces ICE vehicles with 1.7 additional mechanical labor hours, which was also interesting. That speaks to how you manage the high-voltage battery during the process. You have to isolate it in many instances, which often requires additional mechanical labor hours.

Stacey Phillips Ronak